Accelerating Financial Services

Modernization Using the

Databricks Data Intelligence

Platform

The Data Challenge Facing Financial Services Today

Financial Services Institutions operate in one of the most data-heavy and tightly regulated environments in the world. Banks handle enormous volumes of transactional, customer, and risk data every day, all while complying with strict regulatory mandates, safeguarding sensitive information, and enabling real-time decision making across the business.

Yet many institutions are still held back by legacy platforms, siloed data environments, and steadily rising infrastructure costs. These constraints slow down decision making, restrict innovation, and elevate operational risk. To stay resilient and competitive, financial institutions need to modernize their data foundations with a Data Intelligence Platform that brings analytics, AI, and governance together as a core part of their data strategy.

Maximizing ROI: Turning Data into Measurable Business Value

Modernizing with Databricks is not just a technical upgrade; it is a strategic business enabler. Financial institutions moving to a unified data platform achieve measurable Return on Investment (ROI) across multiple dimensions.

| Value Driver | Metric Improvement | Business Impact |

|---|---|---|

| Infrastructure Efficiency | 30%–50% reduction in TCO | Eliminates legacy hardware and optimizes cloud compute usage |

| Operational Productivity | 10× faster pipelines | Engineers focus on innovation instead of maintenance |

| Time-to-Insight | 90% faster query execution | Near real-time access to risk and financial insights |

| Compliance Savings | 60% reduction in audit preparation | Automated lineage reduces manual regulatory effort |

Metric Improvement: 30%–50% reduction in TCO

Business Impact: Eliminates legacy hardware and optimizes cloud compute usage

Metric Improvement: 10× faster pipelines

Business Impact: Engineers focus on innovation instead of maintenance

Metric Improvement: 90% faster query execution

Business Impact: Near real-time access to risk and financial insights

Metric Improvement: 60% reduction in audit preparation

Business Impact: Automated lineage reduces manual regulatory effort

Governance and Security: The Foundation of Trust

In banking, data is both the most valuable asset and the greatest liability if not governed correctly. Databricks addresses this challenge through Unity Catalog and a security‑first platform architecture.

1. Unified Governance with Unity Catalog

Databricks provides a single governance layer for all data and AI assets:

- Centralized Access Control: Manage permissions for tables, files, and machine learning models from one interface

- Automated Data Lineage: Track data flow from raw ingestion to final regulatory reports, simplifying audits

- Data Transparency: Ensure every transformation is documented and discoverable, eliminating black-box ETL pipelines

2. Enterprise-Grade Security

Security is built into the platform by design:

- End-to-End Encryption: Data encrypted at rest and in transit using industry-standard protocols

- Dynamic PII Masking: Sensitive customer data (PAN, Aadhaar, account numbers) masked based on user roles

- Network Isolation: Secure private network deployments prevent exposure to the public internet

Use Case Spotlight: CIC Automation and RBI Regulatory Reporting

In the Indian banking ecosystem, regulatory reporting to the Reserve Bank of India (RBI) and Credit Information Companies (CICs) such as CIBIL and Experian is a mission-critical requirement.

The Challenge

Banks must submit large, error-free datasets to CICs on a weekly or monthly basis. Even minor data quality issues can lead to regulatory penalties and customer dissatisfaction, such as incorrect credit scores. Legacy systems often fail to validate millions of records against complex RBI business rules within strict timelines.

The Databricks Solution

By using Delta Live Tables (DLT) and Unity Catalog, banks can automate the full regulatory reporting lifecycle.

- Automated Data Quality Checks ensure real-time validation, identifying missing PANs, invalid dates, and rule violations early in the process.

- Massively Scalable Processing enables the generation of CIC-compliant fixed-width or XML files for more than 50 million customer records in minutes.

- End-to-End Regulatory Lineage gives auditors a clear, traceable view of how key metrics are calculated, improving transparency and audit readiness.

Outcome

80%

reduction in reporting errors

100%

adherence to RBI submission timelines

Case Study: Transformation at a Leading Private Sector Bank

Business Problem

A leading private sector bank’s Credit Risk Analytics team faced challenges processing data for its entire customer base within monthly SLAs. One critical use case, Debit Scorecard Data Generation, required generating nearly 2,600 derived variables for more than 80 million customers, a scale that was not feasible on a 16 node on premises Hadoop cluster.

Key Challenges

- Scalability Constraints: No burst capacity for peak workloads

- High Infrastructure Costs: Increasing licensing and maintenance expenses

- Limited Governance: Lack of environment separation (DEV/UAT/PROD) and data controls

Solution Architecture

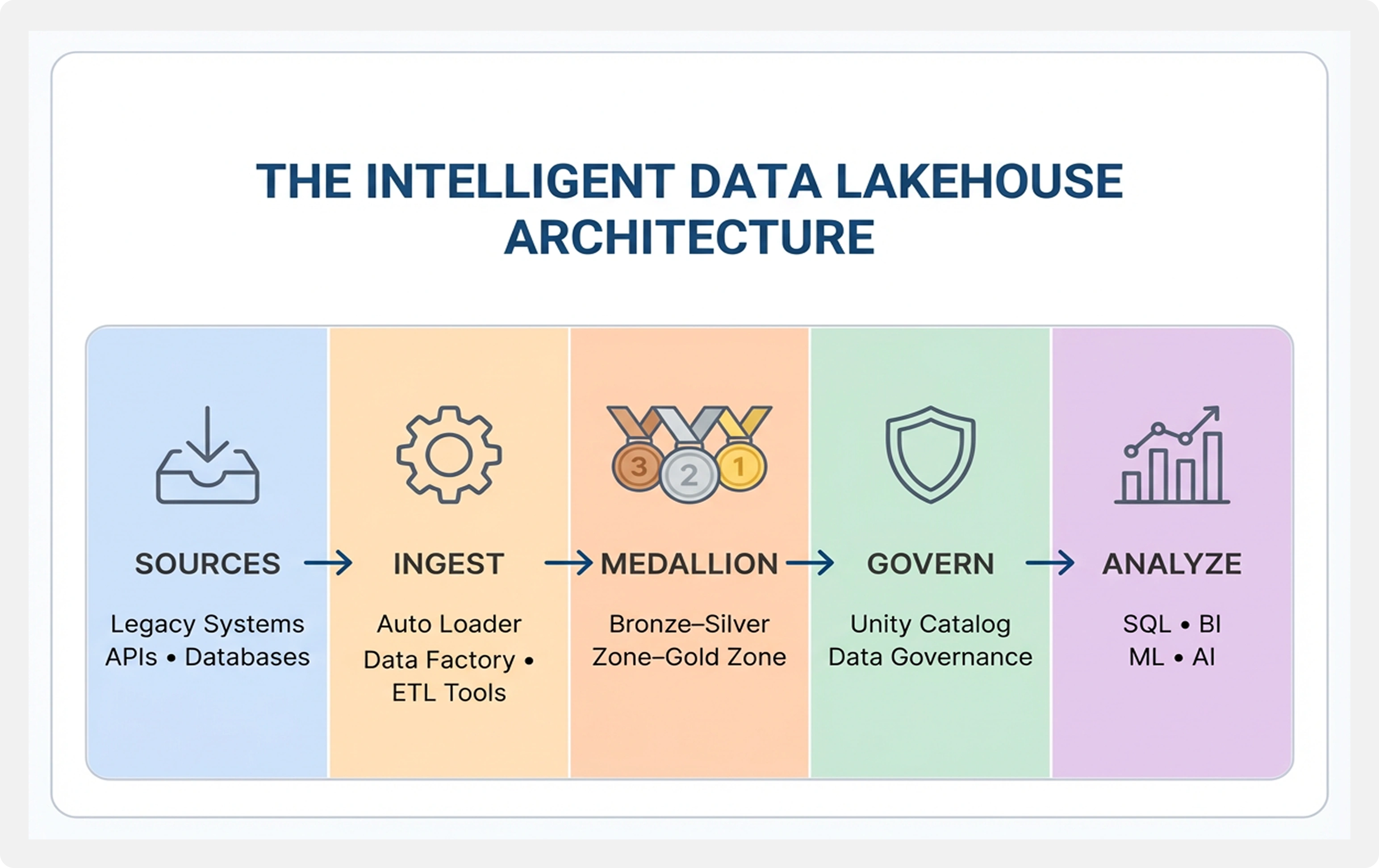

The bank adopted Databricks with a layered Delta Lake architecture:

- Raw Zone: Metadata-driven ingestion of source systems

- Enriched Zone: Business transformations using PySpark and Spark SQL

- Curated Zone: Governed analytics layer with masked PII for data science teams

Business Outcomes

- 10× faster end-to-end data pipelines

- 35% reduction in infrastructure costs

- Processing of 80M+ customer records in hours instead of days

- Unified analytics foundation for engineering and data science teams

Why Partners Play a Critical Role

Technology on its own is not enough to deliver successful modernization. Financial institutions need a clear roadmap that carefully balances performance, cost optimization, and regulatory compliance. Experienced Databricks partners contribute deep domain expertise, accelerate migrations, establish strong governance frameworks, and help institutions realize value faster while reducing risk.

Our Business Case Support Includes

Governance Maturity Assessment

Benchmark your current state against industry standards and identify the highest-impact improvement opportunities.

ROI Modeling

Quantify expected returns using proven frameworks validated across dozens of enterprise implementations.

Stakeholder Alignment

Facilitate cross-functional workshops that build consensus and executive sponsorship.

Success Metrics Definition

Establish KPIs that track progress and clearly demonstrate value to executive sponsors.

Phased Roadmap Development

Design implementation approaches that deliver quick wins while scaling toward enterprise-wide adoption.

Our Clients Have Achieved

60–70%

reduction in time-to-data access

40–50%

reduction in audit preparation effort

3X

faster project deployment on governed data foundations

Measurable compliance cost reduction through automated controls. Whether an enterprise is developing its first business case or scaling an existing governance program, Celebal Technologies brings the expertise needed to turn governance investments into clearly documented, measurable business value.

Conclusion

Modernizing financial services data platforms is no longer optional. It is foundational to resilience, compliance, and growth. The Databricks Data Intelligence Platform enables banks to unify analytics, AI, and governance, transforming fragmented legacy systems into a trusted, scalable foundation. As seen across regulatory reporting and credit risk use cases, institutions can achieve faster insights, stronger compliance, and lower operational costs without sacrificing control. With the right platform and partner, data modernization becomes a strategic enabler, powering intelligent decision making, accelerating innovation, and supporting the next generation of AI driven banking.